2020 W-4 Form Officially Released

The Internal Revenue Service has released a final Form W-4 for use in 2020. A significant change for the 2020 form is that it does not have withholding allowances because employees may no longer claim personal exemptions or dependency exemptions. Previously, the value of a withholding allowance was tied to the amount of the personal exemption.

For the new form, the following five steps (as opposed to allowances) are completed by the employee to determine their withholding:

Step 1: Personal information (including marital status).

Step 2: Multiple jobs (employee), or whether the employee's spouse works. This step is completed if the employee holds more than one job at a time or is married filing jointly and their spouse also works. The correct amount of withholding depends on income earned from all of these jobs.

Steps 3 and 4: Claim dependents and (optional) other adjustments (specifically (a) other income that is not from jobs, (b) deductions, and (c) extra withholding). Steps 3 and 4(b) are completed on Form W-4 for only one job, and these steps are left blank for the other jobs. (Withholding is most accurate if an employee completes Steps 3 and 4(b) on the Form W-4 for the highest paying job.)

Step 5: Employee signature and date (signifying that all information is true and accurate under penalty of perjury).

Publication 15-T (still in draft form) assists employers in determining the amount of federal income tax to withhold from their employee's wages.

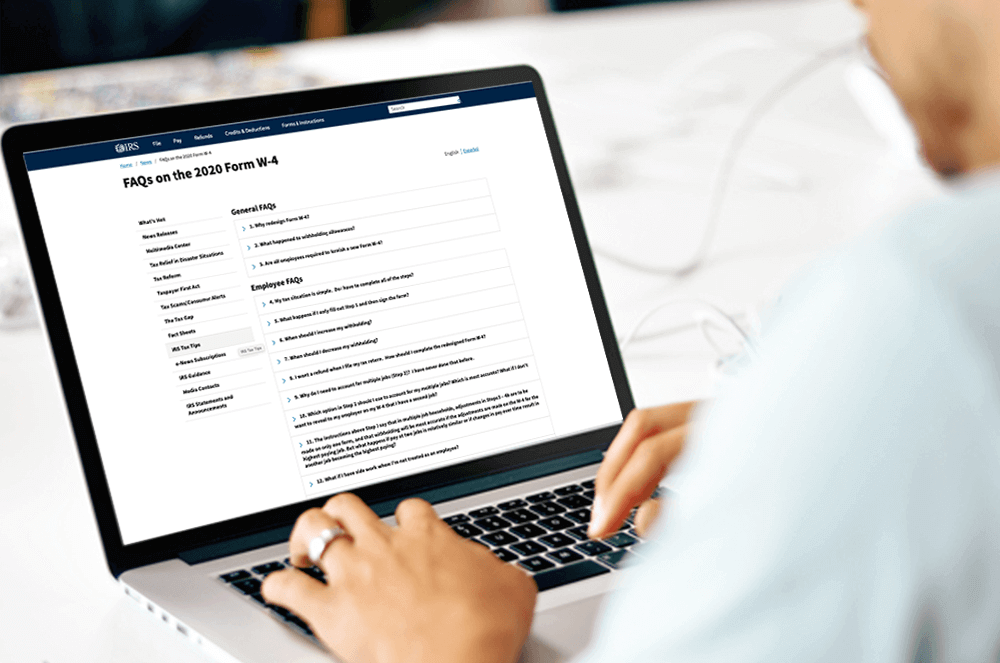

Employees who have submitted Form W-4 in any year before 2020 are not required to submit a new form merely because of the redesign. Employers will continue to compute withholding based on the information from the employee's most recently submitted Form W-4.

For more information, contact the Congruity team of professionals at: 844.247.4100